It is increasingly common to find Irish assets held in a UK domiciled person’s estate. This is not surprising given the close proximity between Ireland and the UK, as well as the development of Dublin as an international financial services centre with a specific focus on asset management.

The commentary below is a short summary of the issues we typically experience when assisting UK estate advisors.

Will Ireland reseal a UK Grant of Probate?

The Irish High Court, Probate Division will not reseal a foreign grant. To access Irish assets in an estate a substantive Irish Grant must be obtained.

Requirements from the UK perspective to apply for an Irish Grant

Where a primary grant of probate issues in the UK, the executors must extract a secondary Grant of Probate in Ireland to obtain title to the Irish estate assets. This is a straightforward application with a court sealed copy of the UK grant of probate and will required as the basis of the Irish secondary grant application.

To further streamline the Irish process, executors may appoint an Irish solicitor as their attorney administrator in Ireland, limited for the purpose of dealing with the Irish estate and the Irish assets. This means that the appointed attorney administrator can then sign all of the Irish probate application papers and ancillary documents. Many executors appreciate this method as it means they are not being requested to sign documents at each step of the Irish probate administration process.

What about Irish tax?

The potential for Irish Capital Acquisitions Tax (“CAT”) arises on Irish situs assets which, unlike UK IHT, is a beneficiary based tax. CAT potentially applies to the value of the Irish situs assets regardless of the residence or domicile status of the deceased or the beneficiary.

There are exemptions from Irish CAT, including assets passing to a surviving spouse. Certain investments, notably units in Irish domiciled funds, are also generally exempt from CAT and a review of the investment will establish whether the exemption applies.

Where exemptions do not apply – for example, funds in Irish bank accounts – the calculation for CAT takes into account the tax-free threshold available to the beneficiary. This is dependent on the degree of relationship between the deceased and the beneficiary. Details of any UK tax paid in respect of which a double tax credit can be claimed are required as part of this calculation.

There may be other tax heads specific to the nature of the Irish assets, though CAT is the primary consideration in each estate.

Even where an Irish solicitor is not appointed as attorney administrator, Irish tax law provides that the solicitor instructed by the non-Irish resident executor will be liable for any unpaid CAT liability of a non-Irish resident beneficiary. Accordingly, in practice it is required that tax returns are filed and a 30-day notice to Revenue issued to allow for the Irish estate to be distributed to a non-Irish beneficiary.

Irish tax numbers are required for both the deceased and the beneficiary as part of the probate process and are applied for as necessary.

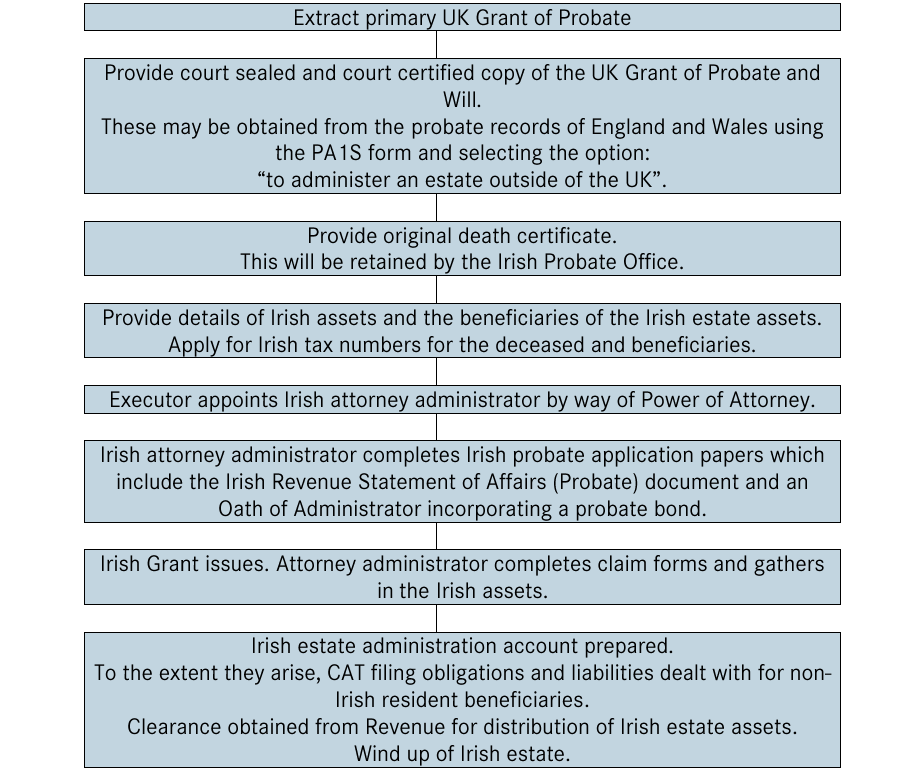

Steps to extracting a secondary Grant in Ireland

Within Matheson’s Private Client department, we are a probate practice team specialising in domestic and foreign estate administrations. Our team of probate and tax specialists are happy to discuss and deal with Irish assets within the context of the administration of UK estates.

For more information on our Private Client services please contact John Gill, Head of Private Client, or view our services page here.

This article was first published in The Law Society PS Magazine on Wednesday, 30 August 2023 and can be viewed here