It had been hoped that the review of the Alternative Investment Fund Managers Directive (“AIFMD“) would be completed by the end of the Swedish Presidency of the Council of the EU (“Council“) in June 2023, but the negotiations on the final text between the European Commission (“Commission“), Council and European Parliament rumble on.

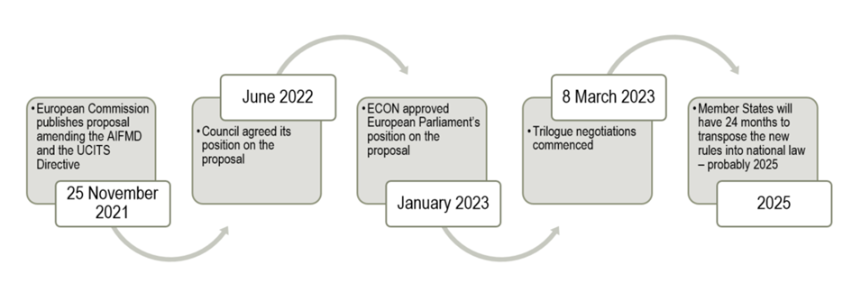

The final rules regarding the loan origination framework in particular have delayed the final agreement. The timeline below sets out the progress to date. In this briefing note, we examine the positions of the European Parliament and Council in relation to some key areas in the AIFMD 2.0 review. Our briefing note summarising the original Commission proposal may be accessed here and our note on the Council’s position may be accessed here.

Delegation

The Commission proposed that the European Securities and Markets Authority (“ESMA“) should receive annual notifications of delegation arrangements where more risk or portfolio management is delegated to third country entities than is retained. ESMA would be required to present regular reports analysing market practices regarding delegation, compliance with the requirements applicable to delegation, and supervisory convergence in this area to the European Parliament, the Council and the Commission to “facilitate informed policy decision in this area”. This might suggest that restrictions on delegation to third countries may be introduced in the future, depending upon the content of these ESMA reports.

In the Council’s agreed text, AIFMs would be required to report additional information to its national competent authority (“NCA“) in relation to their delegation arrangements, including the amount and percentage of the assets under management that are subject to delegation arrangements. While the European Parliament is supportive of increased reporting requirements with respect to delegation, its text does not include the requirement regarding reporting on the percentage of AUM that are subject to delegation arrangements.

The proposals would require AIFMs to provide further information when applying for authorisation. The European Parliament has suggested a new requirement that the AIFM should be required to provide an explanation of the added value of the delegation to the investor, while the Council test would require the AIFM to ensure that the information provided to the NCA as part of the authorisation application is kept up to date. The European Parliament would also require the AIFM to report to the NCA any material changes that may affect the scope of the authorisation and in particular any change to the delegation arrangements.

Loan Origination

The Commission’s proposals to introduce a framework for loan originating AIFs included a requirement for AIFs to retain an economic interest of 5% of the notional value of loans they have granted and sold off, to avoid moral hazard situations where the loans are originated to be immediately sold off on the secondary market. AIFs would be required to adopt a closed-ended structure where they engage in loan origination to a significant extent (60%). The European Parliament and Council have modified this proposal to suggest that loan originating funds should be closed ended when the AIFM is not able to demonstrate to its NCA that the AIF has a sound liquidity risk management system that ensures the compatibility of that system with its redemption policy, with the precise conditions to be specified in regulatory technical standards.

The Council has proposed a leverage cap of 150% for loan-originating AIFs, a change that is not supported by the European Parliament. Currently under the Irish regulatory framework for loan originating funds, there is a leverage cap of 100%.

In relation to risk retention, the Council and Parliament modified the Commission’s proposals, with the Council proposing to limit the retention period to two years or maturity, whichever is shorter.

Liquidity Risk Management

Under the original proposals, NCAs could require AIFMs (including non-EU AIFMs) to activate or deactivate relevant liquidity management tools (“LMTs“). Both the Commission and the European Parliament have proposed that ESMA would be given the power to require non-EU AIFMs marketing AIFs in the EU or EU AIFMs managing non-EU AIFs to activate or deactivate an LMT. The Council does not support his proposal, leaving the decision whether to activate or deactivate an LMT with the AIFM.

Depositary Services

The proposals fall short of introducing a depositary passport. However, the Commission proposed that depositary services could be procured in other member states until further review and the possible introduction of a depositary passport. Both the European Parliament and the Council proposed that member states may authorise the appointment of depositaries in other member states on a case-by-case basis.

Comment

It would appear that there is more negotiating to be done, particularly to reach a final agreement on the new harmonised loan origination framework. Once the text is finalised, the amending directive will need to be formally adopted by the European Parliament and the Council and published in the Official Journal of the EU. Member states will have 24 months from the entry into force of the directive to transpose the requirements into national law. While it is anticipated that the EU law-making institutions will reach agreement this year, the conclusion of the various steps of the process may push the application date into Q1 2026.