One of many hot topics in the private fund market in 2025 was the intersection between fund finance and structured finance and the use of securitisation technology to help financial institutions to manage their balance sheets and to allow asset managers to expand their capital raising efforts. Two structures in particular that have become increasingly prominent in recent years are rated note feeders (or rated feeder funds) (RNFs) and collateralised fund obligations (CFOs).

As widely reported, these structures have evolved as an innovative means for fund managers to attract capital from certain investors (particularly insurance companies) and, conversely, for such investors to invest in private funds or specific / non-traditional asset classes.

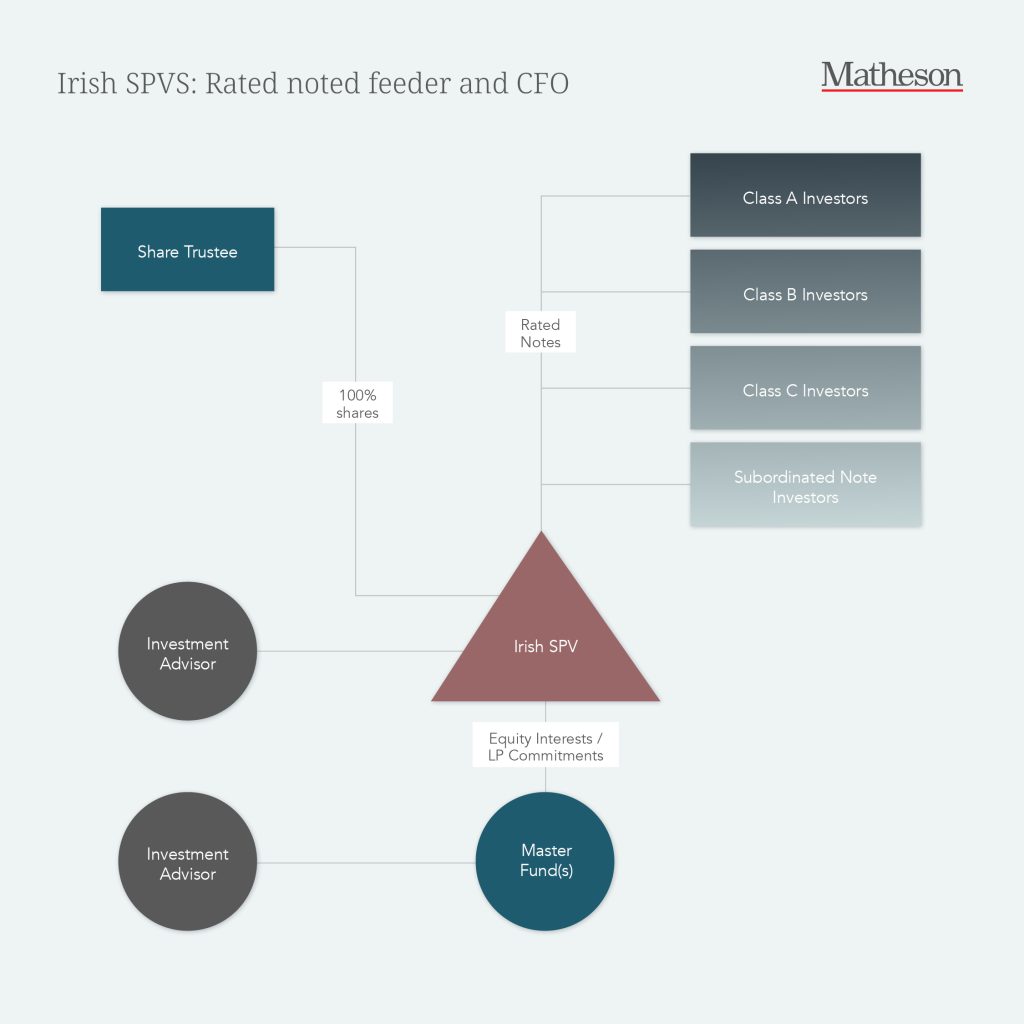

To recap very briefly, RNFs are akin to a traditional fund which invests in a single pool of directly held assets (or indirectly via a master-feeder structure) but, crucially, issue rated securities. CFOs are typically established as bankruptcy remote special purpose vehicles that invest in multiple underlying funds and also issue rated securities. Both structures utilise securitisation technology through tranching of the senior debt (which is typically structured in accordance with investor and rating agency requirements).

RNFs feature regularly in US and European fund structures and, during the course of 2025 (and into 2026), we have seen a number of fund managers look to establish RNFs in Ireland as designated activity companies that avail of Ireland’s securitisation regime (Irish SPVs). Irish SPVs are entities that are widely used in the European securitisation markets and are utilised across a number of mainstream and esoteric asset classes (eg, Irish SPVs are widely used across the European CLO market). Similarly, Irish SPVs are ideal issuer entities for CFOs for the same reasons as they are used as RNFs.

So, why are Irish SPVs an attractive vehicle for RNFs, CFOs and other securitisation transactions? Some of the main reasons are that they:

- are straightforward to establish and can be incorporated within 3-5 business days;

- are typically structured to be bankruptcy remote, are not subject to European regulated fund rules (such as AIFMD) and are tax neutral entities; and

- are well known by rating agencies and the methodologies they apply.

From the perspective of a credit provider to or an arranger of these structures, the usual considerations exist in terms of risk retention and whether the transaction is a “securitisation” for the purposes of the EU Securitisation Regulation.

Given the preferential regulatory capital treatment for certain investors in CFO and RNF transactions and the well-trodden path of using Irish SPVs in the securitisation markets, we expect to see the trend of the fund finance world continuing to intersect with the securitisation world into 2026 (and beyond!).

If you would like to learn more about these structures and Irish SPVs more generally, please feel free to get in touch with the team